Reverse Grid Trading

- What is reverse grid trading?

The principle of reverse grid trading is similar to that of grid trading, that is, arbitrage is carried out by automatically executing high selling and buying low within a certain range under volatile market conditions.

Different from the forward grid, the essence of reverse grid trading is the currency standard, that is, it pays more attention to whether the number of cryptos held increases. The essence of grid trading is U-standard, that is, it pays more attention to whether the number of USDs held increases. Therefore, the way of calculating the profit and loss of assets in grid trading and reverse grid trading is different.

For the FAQ of Grid Trading,please refer to this link.

https://support.matrixport.com/hc/en-us/articles/4412595055769-Grid-trading-FAQ

- Why choose reverse grid trading?

1)Don’t need to monitor the market 24 hours a day, greatly saving your time and energy. This allows you to invest rationally without being influenced by human emotions.

2)By reasonably designing the price range, reverse grid trading can be used as a product to buy coins at a low price, which can easily reduce the cost of holding positions.

3)Easily profit amidst market fluctuations and avoid idle funds.。

- How does reverse grid trading gain profit?

The overall profit of grid trading = grid profit + floating profit and loss

The grid profit is the grid trading profit earned through the grid spread.

Floating profit and loss refers to the price difference between the selling price and the current price of the crypto that have been sold for pending orders (such as BTC, ETH), that is, the floating profit and loss reflected by the selling price being higher than the current spot price.

- How to create reverse grid trading?

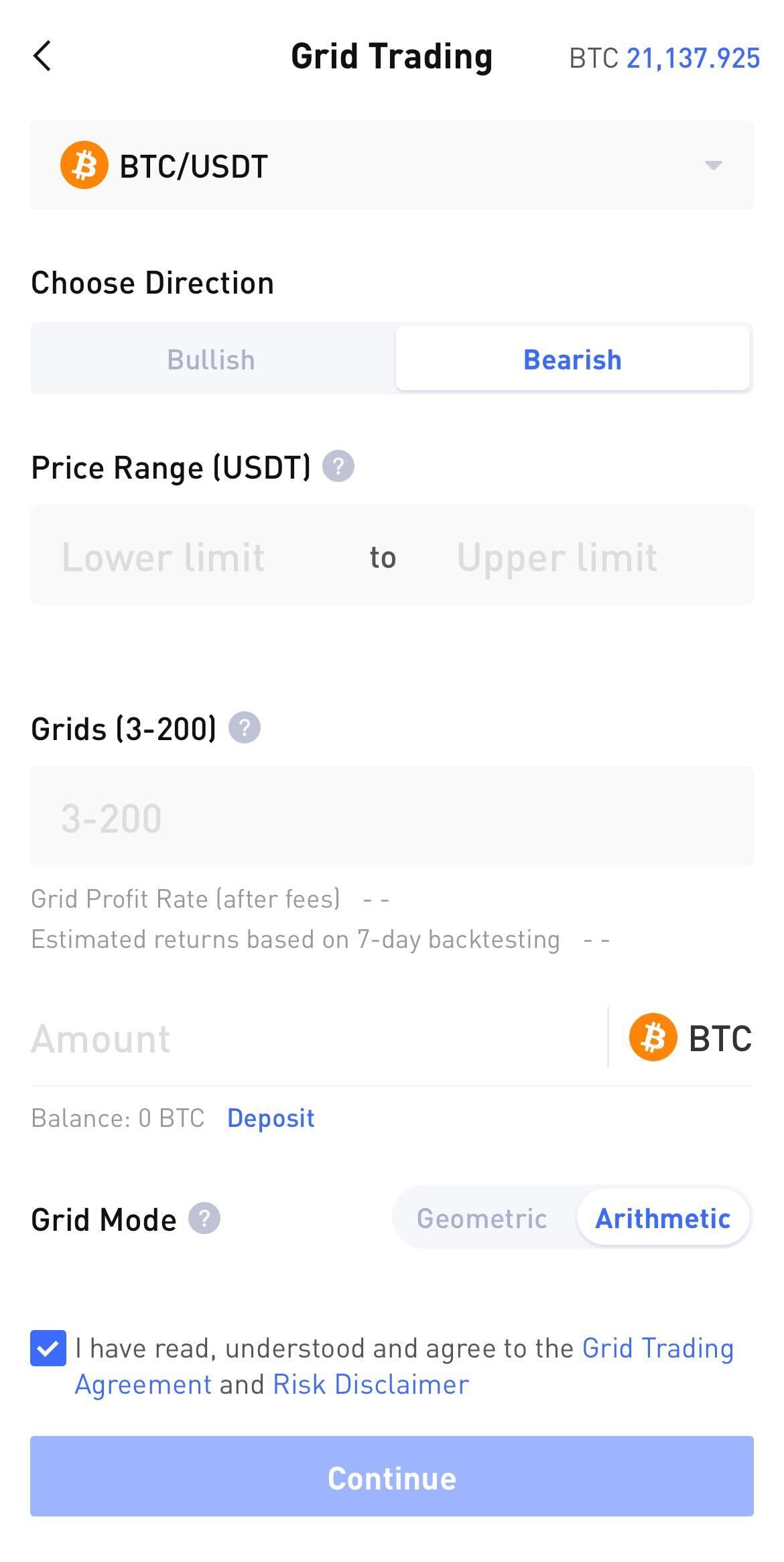

Open the Matrixport APP and select grid trading on the trading page. Select the direction as "Bearish", which is reverse grid trading.

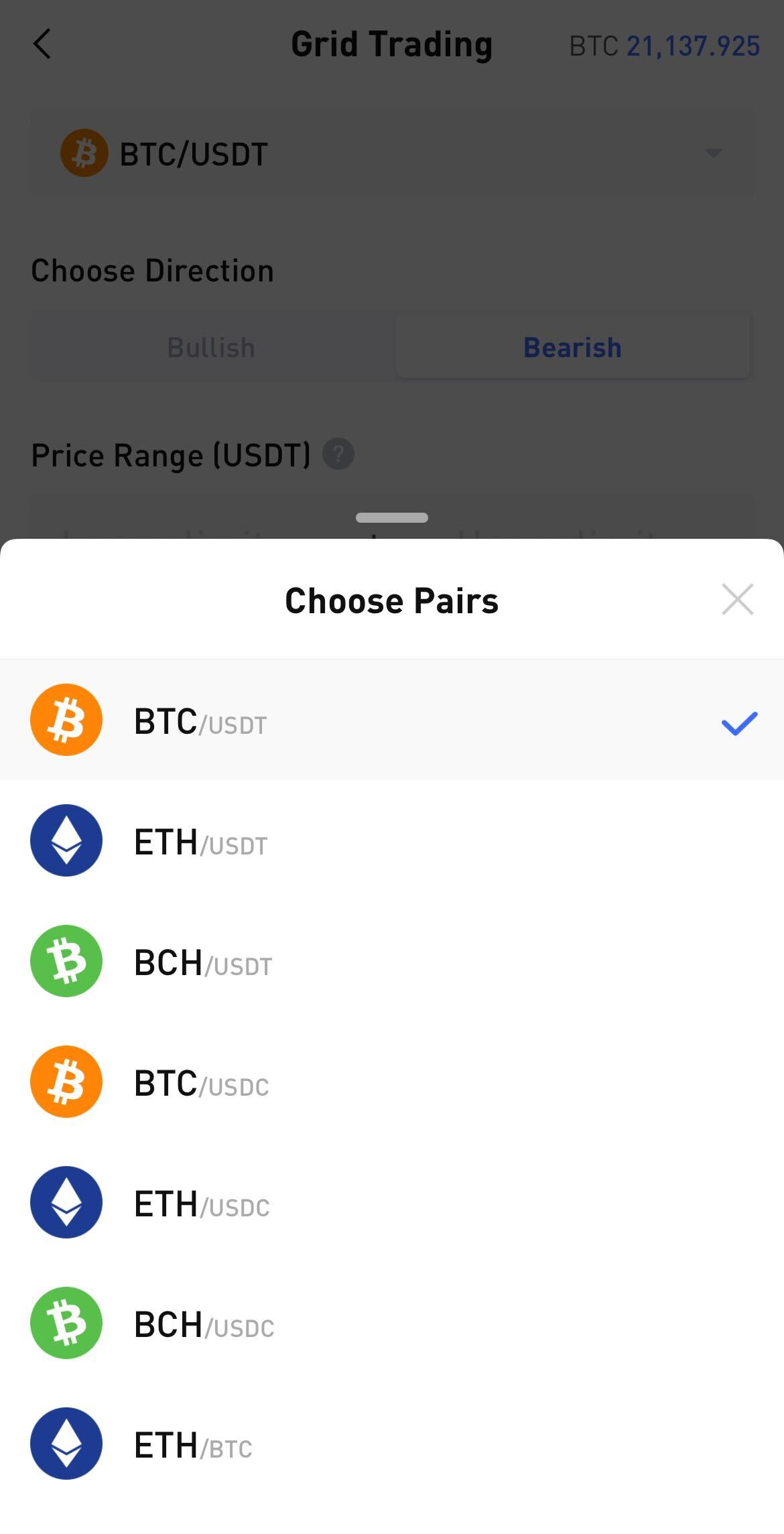

1) Choose a trading currency pair

Currently, the trading currency pairs supported by Matrixport are BTC/USDT, ETH/USDT, BCH/USDT, BTC/USDC, ETH/USDC, BCH/USDC and ETH/BTC. New currencies will be added in the future, please check directly in the App

2) Set the price range

The upper limit price of the interval: The highest price you think the asset can rise to.

The lower limit price of the interval: The lowest price you think the asset can fall to.

Set the minimum price and maximum price of the price range, meaning, the grid will only place buy and sell orders within the price range you set.

When you think the market is fluctuating, it is recommended to set the range to the fluctuation range you think will be respected.

Please note that if the current price is not within the price range you set, the system will not conduct grid transactions (the system will automatically prompt you whether the current price is within the set range).

Assuming that the BTC spot price is 47000 at this time, select the BTC/USDT trading pair

If the price range you set is 48000-50000, your initial investment will not be converted into USDT, but the reverse grid trading bot will not start running until the spot price rises to the price range you set, and then start selling BTC to get the grid profits.

If the price range you set is 44000-46500, the initial investment amount will be fully converted into USDT. When the spot price reaches the price range, the reverse grid trading bot will start to run, placing a buy order to buy BTC.

3) Set the number of grids

The grid quantity is the pending order quantity, and the interval price is divided into corresponding shares. The quantity range that can be set currently is 2-200 grids. If the currency price fluctuates within a single grid, the system will not automatically place an order. The greater the number of grids, the higher the frequency of arbitrage.

4) Fill in the investment amount

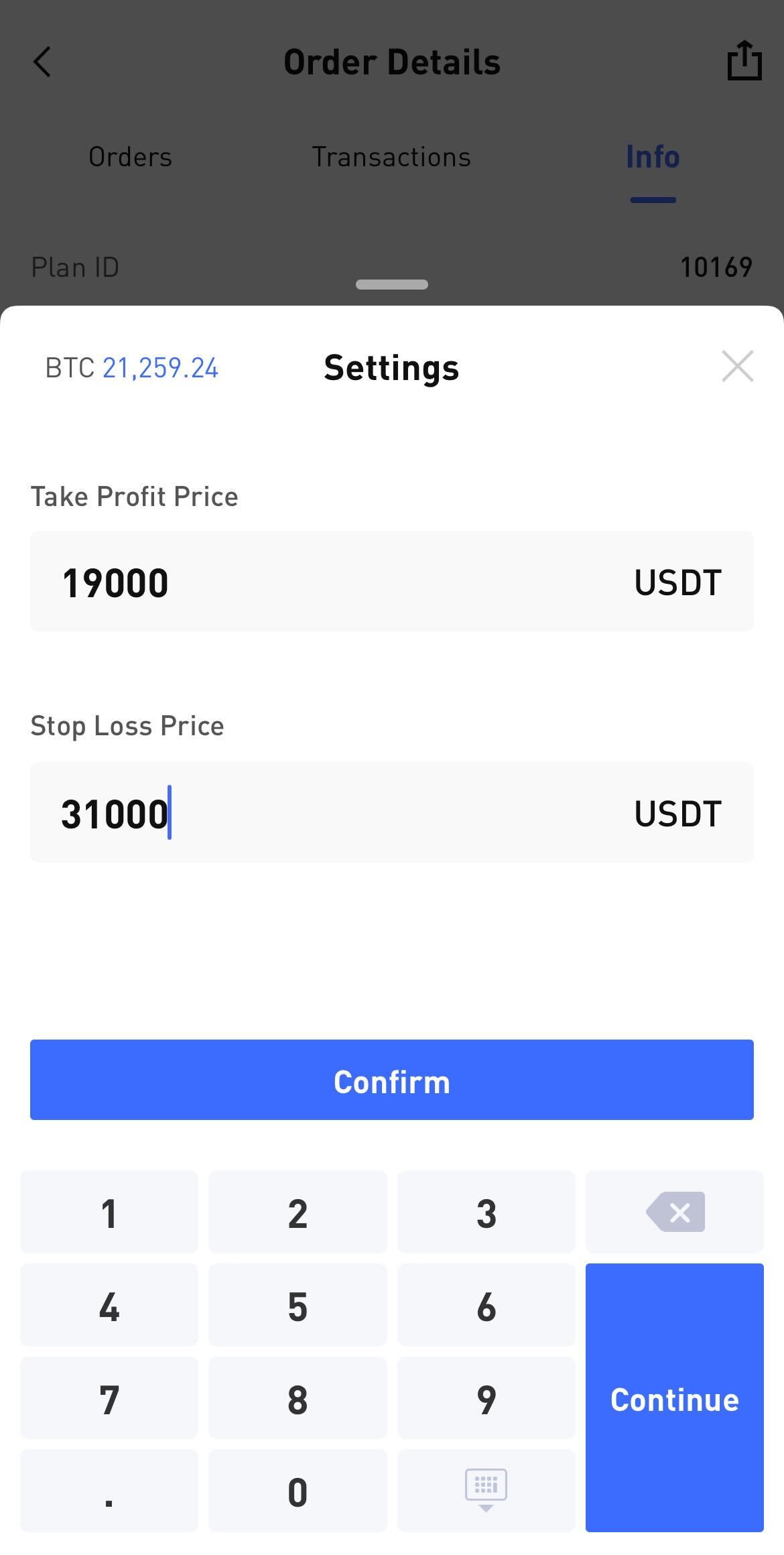

5)Advanced Setting-Stop Loss/ Take Profit price(Optional)

The grid will automatically terminate when the Index price triggers the Take Profit / Stop Loss price.

When the take profit price is triggered, the reverse grid trading bot will be automatically terminated with a single currency(if possible).

When the stop price is triggered, the reverse grid trading bot will be automatically terminated in two currencies.

For example, when selecting the BTC/USDT trading pair, the order triggers the stop loss price, and the reverse grid trading bot will terminate the position with the BTC and USDT held; if the order triggers the take profit price, the reverse grid trading bot will automatically buy BTC with all USDT.

For reverse grid trading, the take profit price needs to be lower than the lower limit price and the current currency price, and the stop loss price needs to be higher than the upper limit price and the current currency price.

6)Select grid pending order mode

Grid pending orders are divided into two modes, geometric grid and arithmetic grid.

An arithmetic grid means that the price difference between each grid is the same. Price difference per grid = (grid upper limit-grid lower limit) / number of grids

A geometric grid means that the increase between each grid is the same. The price ratio of each grid = (the upper limit of the grid / the lower limit of the grid)^ (1/the number of grids)

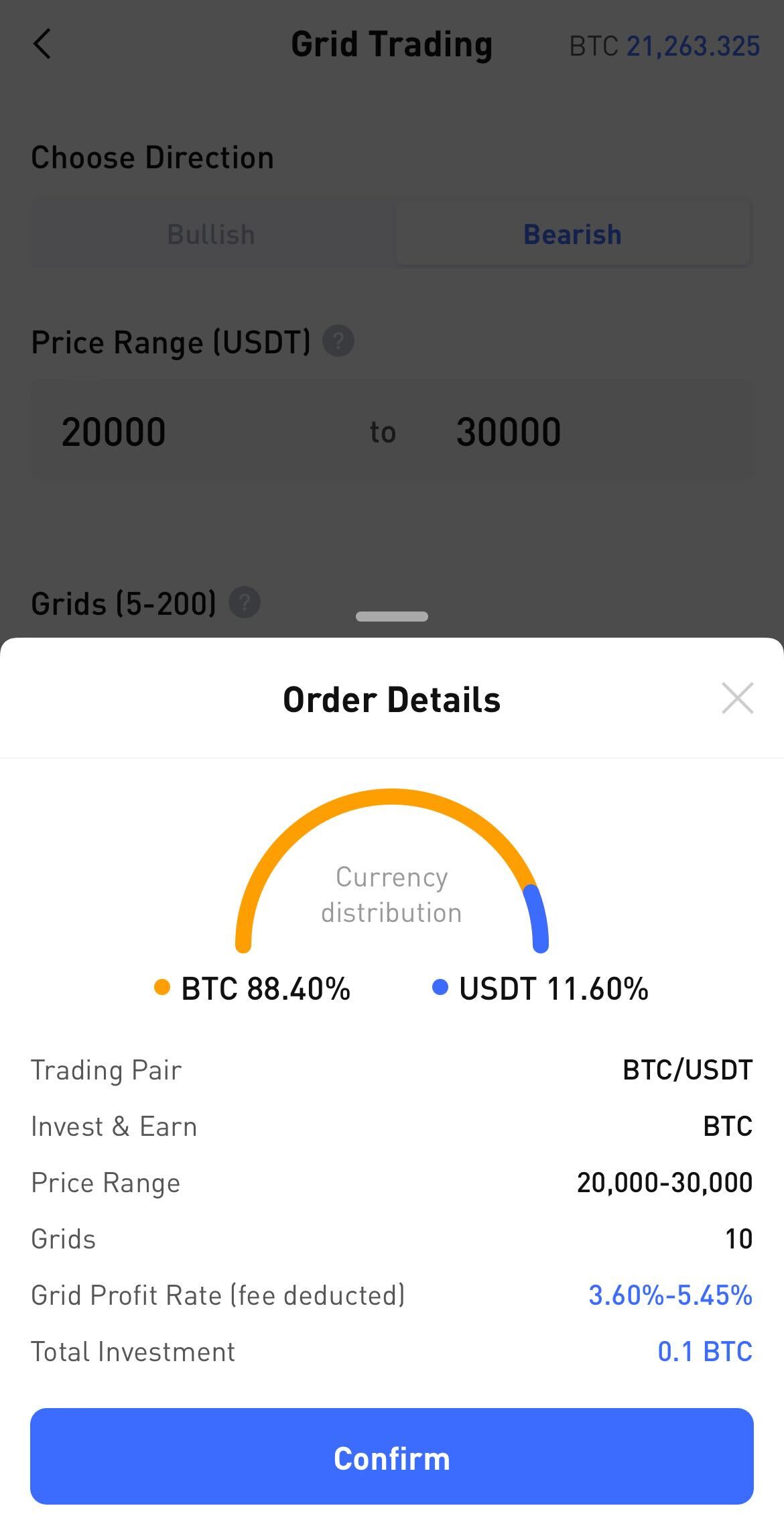

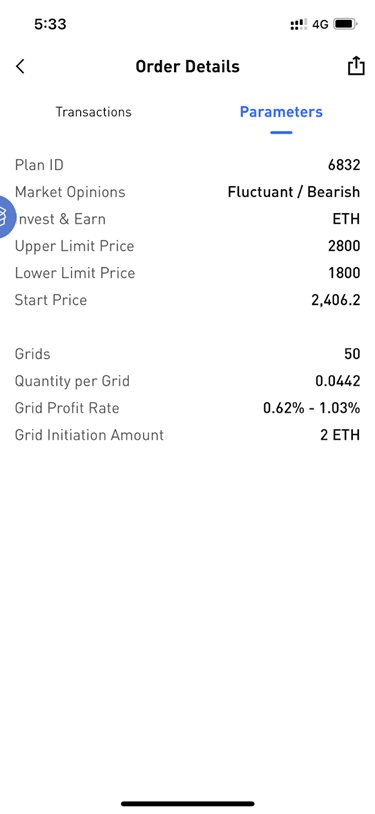

7) Confirm order

After setting the parameters and carefully reading the investment agreement and risk warning, reconfirm the trading pair, investment currency, price range, grid number, profit per grid (deducted service fee), and investment amount.

Please note that assuming that the trading currency pair you select is BTC/USDT, after investing BTC at the beginning, the system will automatically sell a certain percentage of USDT to open a position. When the price fluctuates within the set price range, the system automatically buys low and sells high, and the position contains both BTC and USDT. If it exceeds the price range, the reverse grid trading bot will automatically stop, and all positions held at the end will be USDT; otherwise, if it falls out of the price range, the grid will automatically stop, and all positions held at the end of will be BTC.

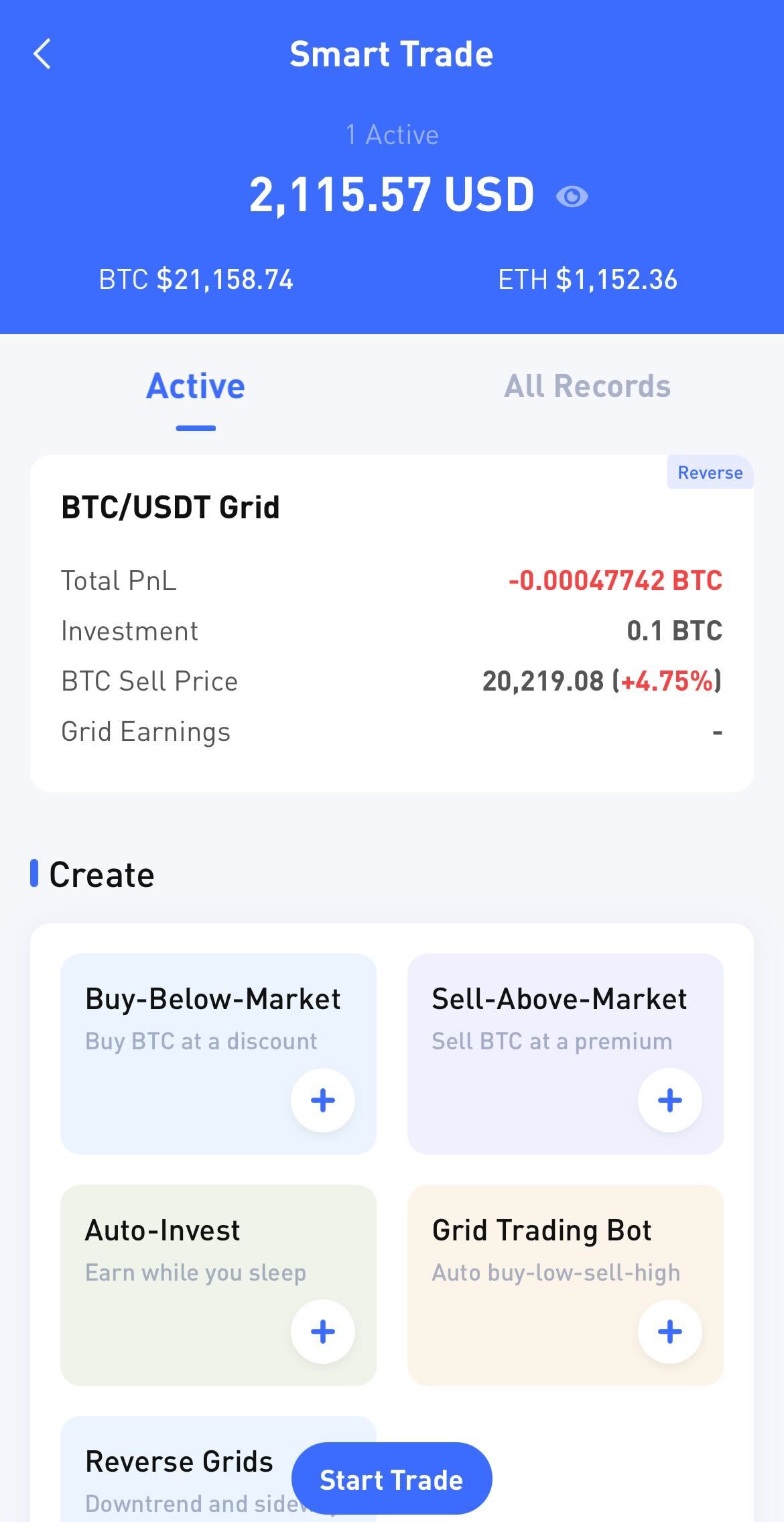

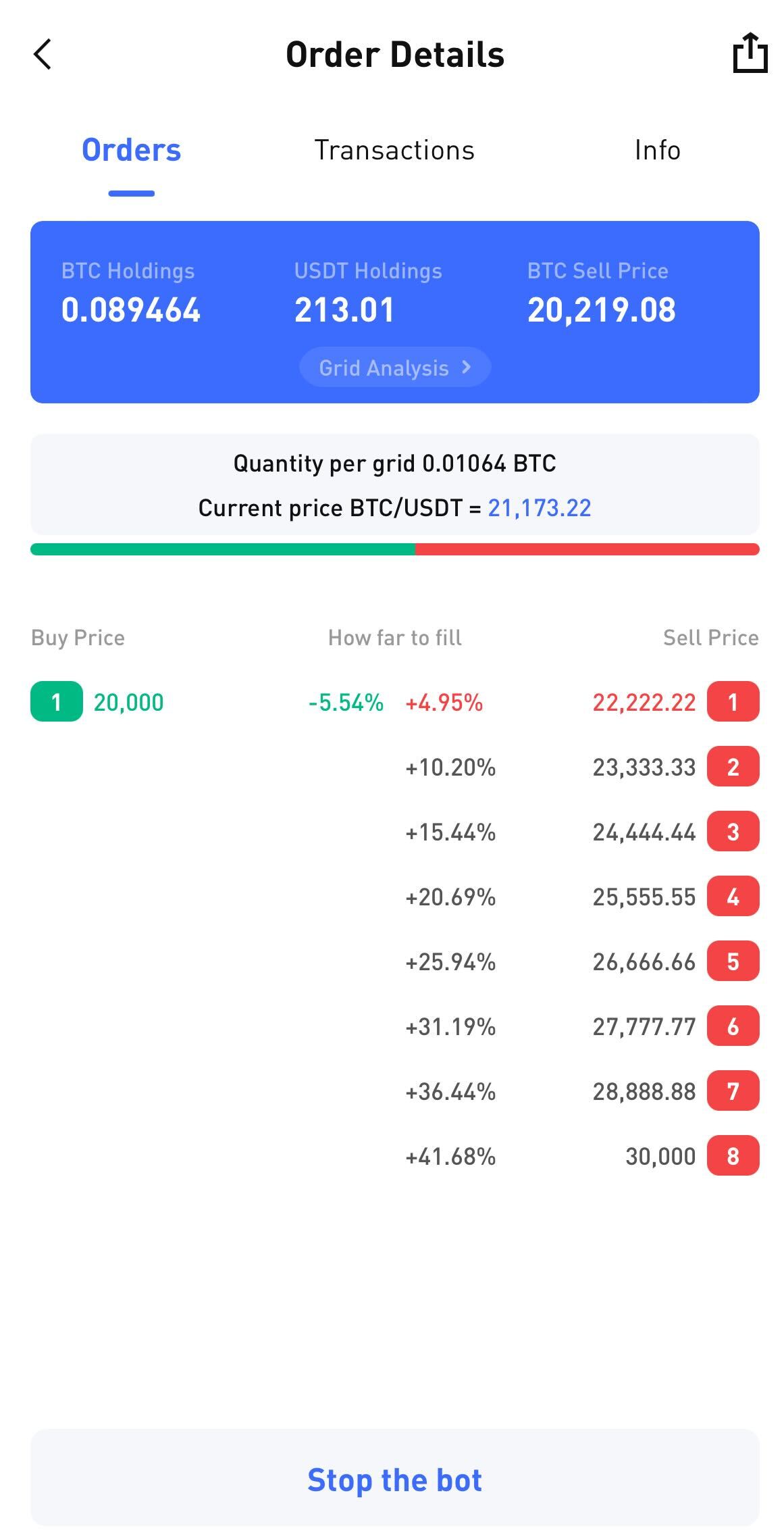

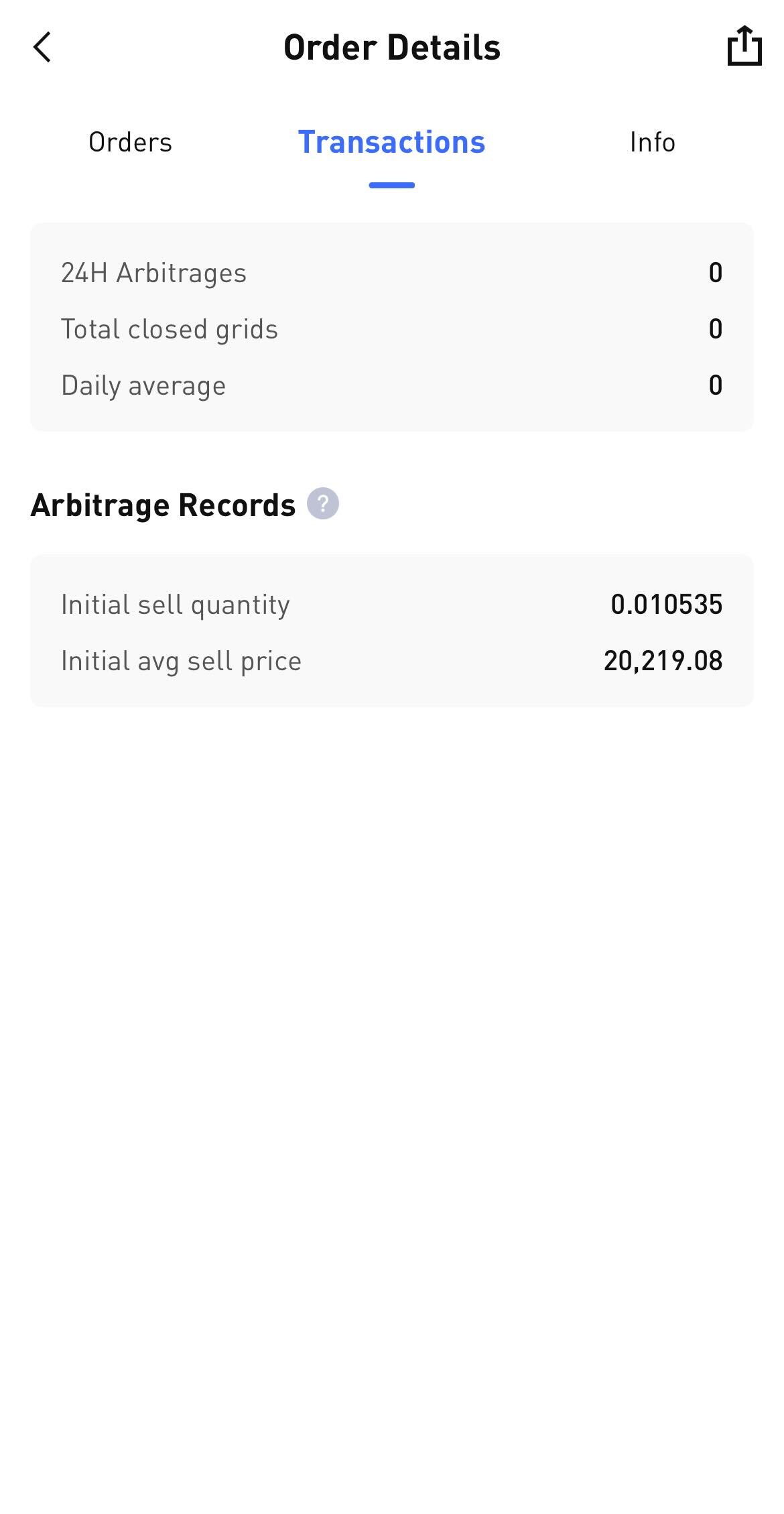

- How can I view my grid?

Click the grid-in the holding order details, click the corresponding grid transaction, you can see the grid's pending order details, holding placed, transaction records and order parameters. One arbitrage represents a buy and a sell.

Grid profit = the price difference between buying low and selling high in the price range-the handling fee of two transactions.

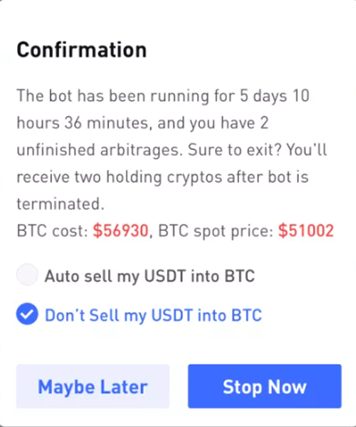

- How to terminate grid trading?

Click on a grid, in the “order details” page, click on "Stop the bot" at the bottom. After clicking, a second confirmation window will pop up. Choose the settlement currency by yourself. If you don't choose it yourself, the system will default to the higher profit settlement currency and proceed to checkout. Click "Stop Now". After the grid is successfully terminated, you can view the details of the terminated order.

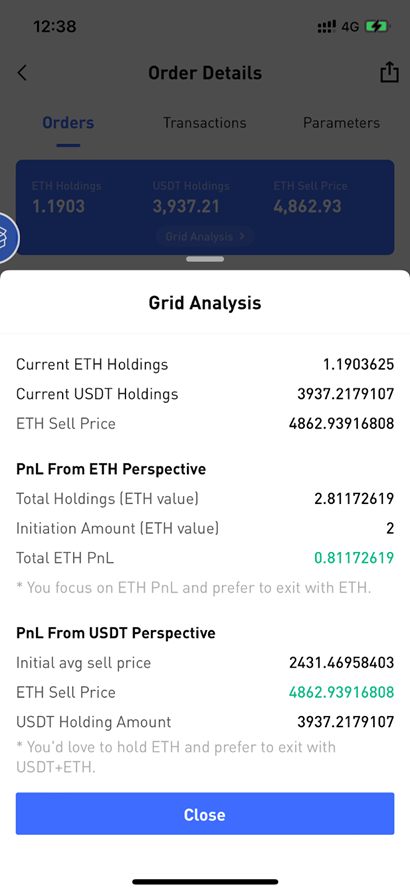

- How to check grid analysis?

Matrixport also provides two-dimensional profit and loss analysis of currency pairs to help you make better investment decisions. As shown in the figure, PnL From ETH Perspective is suitable for users who want to exit the grid only with BTC. The total Holding (ETH value) is the BTC position cost. PnL From USDC Perspective is suitable for users who want to exit the grid with both USDT and ETH, so it shows the ETH sell price.

- FAQ

1)Can reverse grid trading be used for shorting in a downtrend?

Answer: No, the principle of reverse grid trading is similar to grid trading, it is bearish in the short term and still bullish in the long term.

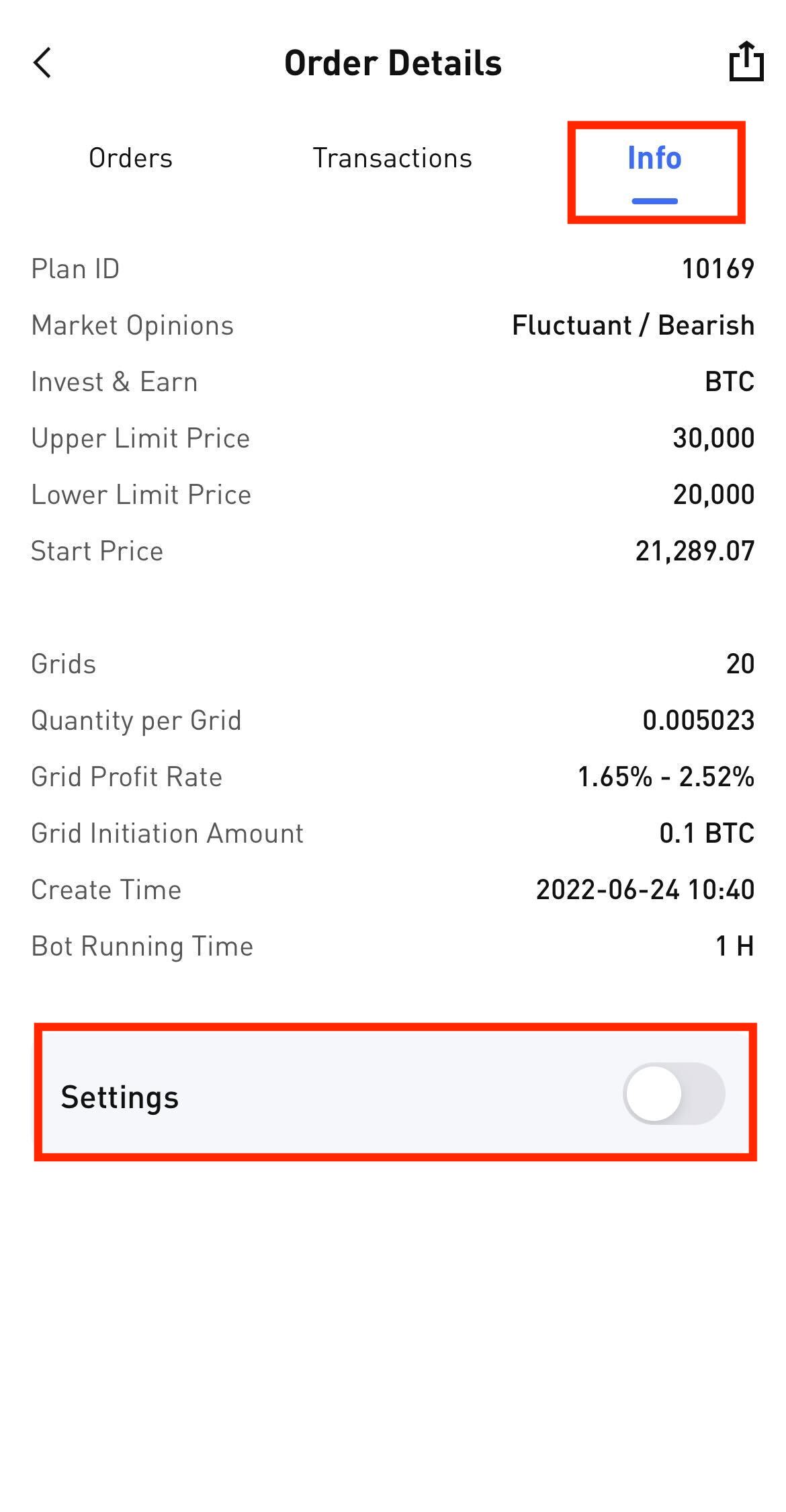

2)Can the take profit / stop loss prices still be modified after the reverse grid trading bot starts?

Answer: You can add or modify Take Profit / Stop Loss prices at any time. Click to enter the ‘order details’ page , and then click ‘Info’, and modify the settings at the bottom of the page.

3) Can grid trading and reverse grid trading be used for hedging?

Answer: The two grids cannot be hedged. The principles of grid trading and reverse grid trading are similar, only the way of calculating profit and loss is different. The essence of both is to buy high and sell low within a certain range to obtain profits.

4) What are the applicable scenarios of reverse grid trading bot?

Answer: Take the BTC/USDT trading pair as an example. Turn on the reverse grid trading bot in a volatile market/unilateral falling market. If the spot price at this time is within the price range you set, part of the BTC you invested will be sold and converted into USDT. If the spot price of BTC continues to fall , you can not only get the grid profit of buying low and selling high within the range, but also increase the amount of BTC held.

In addition, you can also choose to open the reverse grid in the bear market to earn more coins and wait for the arrival of the bull market.