Grid trading FAQ

- What is grid trading?

Grid trading is a quantitative trading strategy in which USD StableCoins are invested as the principal, and by automatically executing buy low and sell high within a certain price range, so as to obtain profits from market fluctuations.

- Advantages of grid trading

1) Don’t need to monitor the market 24 hours a day, greatly saving your time and energy. This allows you to invest rationally without being influenced by human emotions.

2) By reasonably designing the price range, grid trading can be used as a product for earning USD StableCoins or as a product for scientifically buying coins.

3) Easily profit amidst market fluctuations and avoid idle funds.

- How does grid trading gain profit?

Based on the U standard, the overall profit of grid trading = grid profit + floating profit and loss

The grid profit is the grid trading profit earned through the grid spread.

Floating profit and loss refers to the price difference between the current holding cost of unsold coins (such as BTC, ETH) and the initial cost of opening a position.

- How to create a grid transaction?

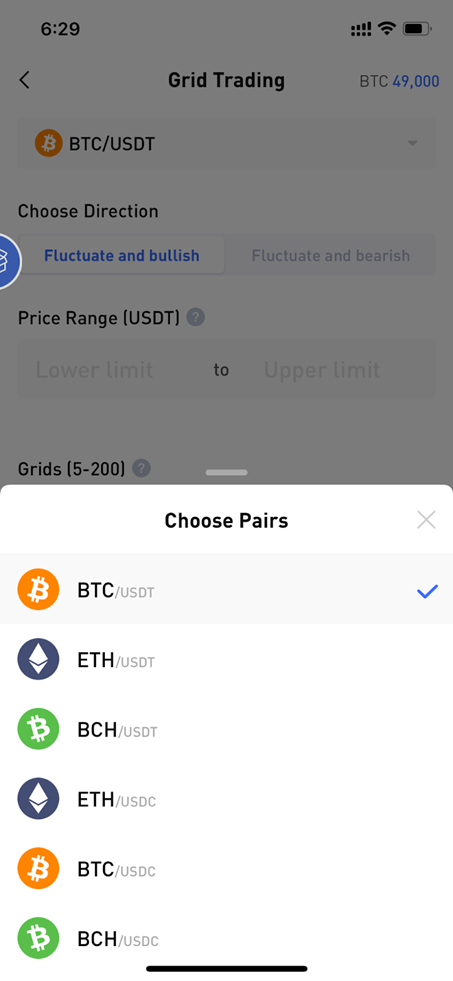

Open the Matrixport APP and select grid trading on the trading page. Select the trading pair at the top,

1) Choose a trading currency pair

Currently, the trading currency pairs supported by Matrixport are BTC/USDT,ETH/USDT,BCH/USDT,BTC/USDC,ETH/USDC,BCH/USDC,DOGE/USDT.

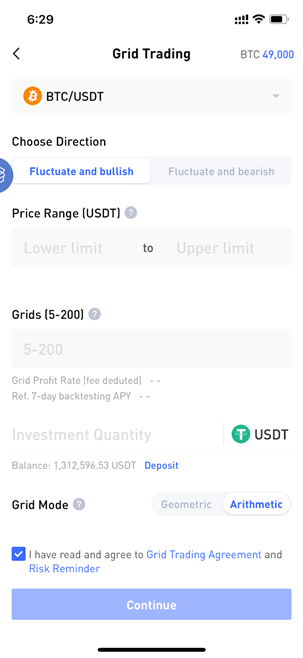

2) Set the price range

The upper limit price of the interval: The highest price you think the asset can rise to.

The lower limit price of the interval: The lowest price you think the asset can fall to.

Set the minimum price and maximum price of the price range, meaning, the grid will only place buy and sell orders within the price range you set.

When you think the market is fluctuating, it is recommended to set the range to the fluctuation range you think will be respected.

When you want to buy coins and want to control the cost price, it is recommended to set the range to the price you want to buy coins.

Please note that if the current price is not within the price range you set, the system will not conduct grid transactions (the system will automatically prompt you whether the current price is within the set range). Assuming that you set the BTCUSDT grid price range from 60000 to 70,000, and the current price of BTCUSDT is 50000, which is lower than the lowest price of the set range, the grid will no longer open positions.

3) Set the number of grids

The grid quantity is the pending order quantity, and the interval price is divided into corresponding shares. The quantity range that can be set currently is 2-200 grids. If the currency price fluctuates within a single grid, the system will not automatically place an order. The greater the number of grids, the higher the frequency of arbitrage.

4) Fill in the investment amount

5) Select grid pending order mode

Grid pending orders are divided into two modes, geometric grid and arithmetic grid.

An arithmetic grid means that the price difference between each grid is the same. Price difference per grid = (grid upper limit-grid lower limit) / number of grids

A geometric grid means that the increase between each grid is the same. The price ratio of each grid = (the upper limit of the grid / the lower limit of the grid)^ (1/the number of grids)

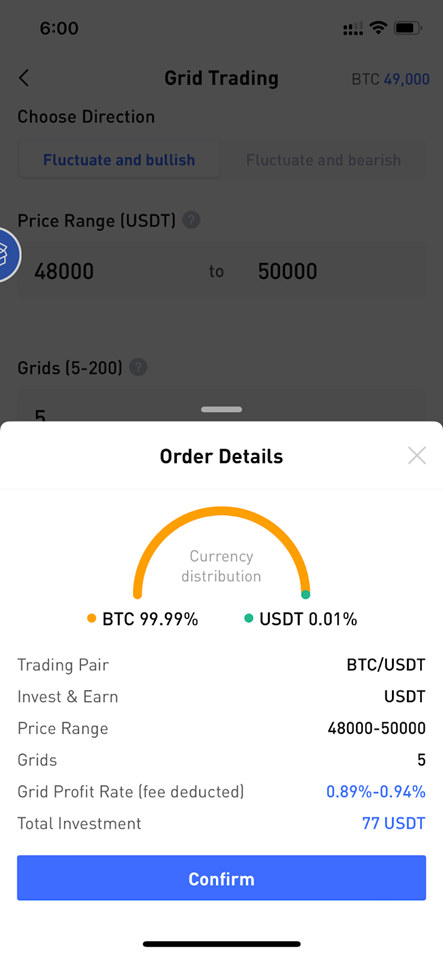

6) Confirm order

After setting the parameters and carefully reading the investment agreement and risk warning, reconfirm the trading pair, investment currency, price range, grid number, profit per grid (deducted service fee), and investment amount.

Please note that assuming that the trading currency pair you choose is BTC/USDT, the system will automatically buy a certain percentage of BTC to open a position after USDT is invested at the beginning of the period. When the price fluctuates within the set price range, the system automatically buys low and sells high, and the position contains both BTC and USDT. If the price breaks through the set price range, the grid will stop running, and all positions held at the end of the period will be USDT; otherwise, if the price falls below the set price range, the grid will stop running, and all positions held at the end of the period will be BTC.

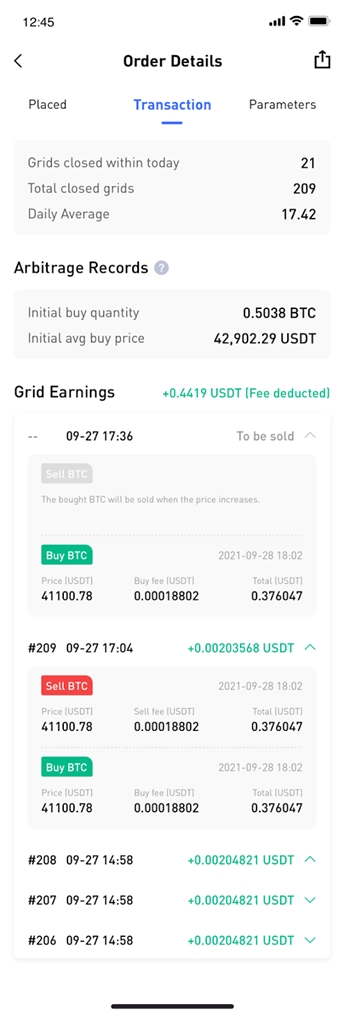

- How can I view my grid?

Click the grid-in the holding order details, click the corresponding grid transaction, you can see the grid's pending order details, BTC/USDT holding placed, transaction records and order parameters. One arbitrage represents a buy and a sell.

Grid profit = the price difference between buying low and selling high in the price range-the handling fee of two transactions.

- How to terminate grid trading?

Click on a grid, in the “order details” page, click on "Stop the bot" at the bottom. After clicking, a second confirmation window will pop up. Choose the settlement currency by yourself. If you don't choose it yourself, the system will default to the higher profit settlement currency and proceed to checkout. Click "Stop Now". After the grid is successfully terminated, you can view the details of the terminated order.